How to Ace Your Income Tax Interview and Get the Job?

If you are looking for the most frequently asked Income Tax interview questions and answers, this blog will show you exactly what hiring managers want by putting up these questions.

Interviews can be daunting and with on and off changes in the recruiting world, it can be pretty unnerving to know which answers to get ready with for a job interview these days. Whatever the case, stay rest assured!! After a bit of research, I found a handful of income tax interview questions asked during the interview process.

Now let’s dive into the top 35 income tax interview question and answers that might be helpful to you. I further hope by the end of this blog, you would feel comfortable answering these questions if you come across them in an interview. Let’s jump in!!!

1. What is Income Tax? How can you calculate it?

The government authorities impose income tax on an individual’s earnings. In addition, the government charges this tax for the corresponding evaluation year on the quotes laid down by the Finance Act for the evaluation year regarding the preceding year.

Moreover, the income of the individual is classified beneath the subsequent five heads:

- Salaries

- Income from residential property

- Profits of commercial enterprise or profession.

- Capital profits

- Income from different initiators.

2. What is marginal profit? How can you calculate it?

The concept of marginal profit intends to provide taxpayers with remedies when claiming additional charges if their total income is slightly above 1 crore or 10 crores in some cases. Therefore, while calculating the surcharge, if the taxpayers have a total income of more than 100 million rupees, the net amount is the corporate tax and accrued surcharge. Moreover, the amount does not exceed the total source.

3. How can you calculate total tax liability?

After determining your total income, the next step is to calculate your annual tax obligations. In other words, we calculate the tax obligations by using the tax rates specified for this purpose. See the tax rate section for tax rates. The example below will help you understand how taxpayers calculate their total tax obligations.

Total income and tax obligation calculation for the year-

Details Amount

Income from salary XXXXX

4. How do round your total income before calculating your tax obligations?

According to Section 288A, we round off the total income to the nearest multiple of 10 decided under the provisions of the Income Tax Act. Consider the following when rounding off your total income: First, neglect the rupee part that consists of paisa.

5. How do you anticipate your organization’s tax obligations for the next fiscal year?

This is indeed a functional question that interviewers use to evaluate your expertise and understanding. In addition to it, the interviewer wants to verify your eligibility for the position you are applying for. During the interview, the interviewer will ask you many questions of this kind. Hence, to answer this question, give an outline of the procedure you are using as well as list out the particular issues that may affect the procedure.

6. How do you help your customers with late tax payments?

This is a conditional question that will help the interviewer learn your tax accounting expertise and discover how to deal with complex scenarios. However, many individual taxpayers face late taxes, which are also common in the professional world. Hence, the ultimate approach to solving complex or pessimistic situations is to use your skills directly to solve your problem as rapidly as possible. Further, please provide an answer to substantiate this point.

7. Can you describe long-term capital gains and how they differ from short-term capital gains?

This is a mechanical question related to the income tax interview question and answers series. This question promptly evaluates your mastery of standard accounting implementation. Keeping that in mind, it is indeed great to answer such mechanical questions instantly and concisely with plain interpretation. However, in some areas, you have to give a simple illustration to explain the answer. Hence, prepare yourself to ask the interviewer any relevant questions or other related details of the subject.

8. Define an alternative minimum tax and explain its uses.

This is yet another practical question. In other words, the primary objective of the question is to explain the concept as you understand it. Again, you should cite an illustration or a brief description of how the concept is helpful in your career. Remember to keep this explanation simple here. Because the more details you give regarding the concept, the more confusing your situation could be.

9. What does company liquidation mean?

Liquidation of a company means that the company’s assets are realized, its liabilities are repaid, and any surplus is distributed according to the rights of its shareholders. Moreover, the dissolution of the company involves the dissolution of the union, but the company doesn’t need to be dissolved due to the dissolution of the union.

10. What do you understand by TDS?

TDS stands for Tax deducted at source. In other words, the tax subtracted from the source of earnings is TDS. However, income tax requires the paying company or individual to subtract withholding tax, if the payment surpasses a specific standard amount.

The following kinds of deposits include TDS:

- Salary

- Bank interest payment

- Fee payment

- Rent deposit

- Consulting fee

- Professional compensation.

11. What does Total Income mean?

Total income is the aggregate of income tax you pay. In addition to it, total income covers all income generated, obtained or accepted in India. Again, gross income is the total sum of income a person or an institution earns, covering income from the provision of employment, income from sales, deposits from pension schemes, income from return on investment, and other sources of income.

However, we calculate total income for tax purposes, valuation of a company’s net worth or determination of an individual’s capacity to repay debt.

12. Name the heads falling under the category of total income.

Generally, there are five heads under total income. They are classified as follows:

- Income from salary

- Income from home ownership

- Benefits from the profession

- Capital gains

- Income from other sources of income.

13. What does FBT mean?

FBT stands for Fringe Benefits Tax. It is a tax that a proprietor must pay in connection with the benefits provided to an employee. Moreover, fringe benefits are the benefits that the employer grants to his employees in addition to cash salaries. Further, the employer pays FBT on account of the value of benefits he provides or decides to provide to the employee in the preceding year.

14. What does a tax audit mean?

Again, the interviewer asks this question frequently in the income tax interview questions and answers. A tax audit is an evaluation of an institution’s or an individual’s tax return by the Internal Revenue Service to determine if income and deductions are calculated accurately

15. How will you define Amortization and Impairment?

When a company’s assets are depreciated for the cause of renewal or replacement for many years, regardless of the life of the asset, it is known as amortization. However, it is different from depreciation, which periodically depreciates an asset based on normal life expectancy.

On the contrary, impairment is the depreciation of an asset due to physical destruction, old-fashioned, or innovation. Moreover, depreciation costs can be depreciated. To be precise, impairment is the variance between the fair value of an asset and its carrying amount.

16. What do you understand by Intercompany coordination?

The joint venture prepares consolidated financial statements annually for tax and reporting purposes. In addition, intercompany coordination is a procedure that assists in separating the parent company from its subsidiaries by location. Moreover, jointly controlled companies are required to draft consolidated financial statements annually for tax as well as for reporting reasons.

Again, the intercompany accounting process is an essential process for a parent company or a company separated by location. Likewise, ICR also guides to maintain accurate reports as well as helps to avoid double-counting transactions. Lastly, it helps the company avoid misrepresenting the company’s monetary status.

17. What do you mean by a Securities Transaction Tax?

Securities Transaction Tax (STT) was initiated in India as of the 2004 budget and was applicable from October 1, 2004. In other words, it is a tax paid on the amount of taxable securities transactions. Moreover, STT will only be charged for the purchase as well as the sale of securities enlisted on the Indian Stock Exchange, P. Chidambaran, the former finance minister introduced this to tax prevent people from tax evasion on capital gains.

18. Which year is the fiscal year, the previous year, and the evaluation year?

The year from April 1 to March 31 is termed the fiscal year. It is used to calculate various financial statements for a company or an institution.

The year following the fiscal year in which the income of the previous fiscal year is assessed is called the assessment year. For collections, the government uses the tax year to evaluate the previous year.

Lastly, the year in which income generates and taxable in the year following the assessment is the previous year. To illustrate, 2021-2022 is the current evaluation year and 2021-2020 is the previous year.

19. What do you mean by Assessee?

Those who have to pay taxes or other amounts under the Income Tax Act are assessors. Moreover, it includes those who are trusted to determine their income or the income of others who are taxable or the losses they or others have suffered in connection with the procedures under this Act.

20. How do I determine the status of residence of an income tax or income taxpayer?

According to the Income Tax Act, an individual’s residence status is classified into resident and non-resident. Therefore, according to Section 6 (2), a person is a resident of India in the previous year if he meets any of the basic requirements. That means if he maintains at least 60 days in the relevant previous year, it is considered in India at least 365 days in the last four years.

If you do not comply with this provision, you are a non-resident regardless of your nationality.

21. What is a Provident Fund. Explain its types.

The Provident Fund is a government-controlled system in which both the employer and the employee contributions from the employee’s salary. Again, there are four types of reserve funds:

Certified Funds

It is a fund that requires the approval of the Director of Income Tax and applies to organizations that employ 20 or more employees.

Unapproved Provident Fund

The income tax commission does not approve it and the employers and employees establish it in one entity.

Legal Provident Fund

It primarily includes employees of educational institutions (university affiliations).

Public Provident Fund

PPF includes a minimum contribution of rupees 500 per year and a maximum contribution of rupees 100,000 per year. Deposits with interest will be repaid after 15 years unless rewarded.

22. What does Excise duty mean?

Indirect taxes are charged on goods manufactured in India for personal use. Furthermore, the taxable person is the producer, and excise tax is levied on the goods produced. In addition, the manufacturer pays this tax and passes it on to the customer.

23. What does a Service tax mean?

The government imposes a service provider on a particular service, but the indirect tax paid by the customer is the service tax. The service tax includes facilities such as AC restaurant services, hotels and inns

24. How is excise tax different from the service tax?

Excise tax is also an indirect tax levied on the manufacture, sale or use of specific kinds of goods or products. Moreover, it is usually charged on the price of goods namely cigarettes and alcohol

In addition, both federal, as well as state agencies, collect excise tax. On the other hand, service tax is levied on the services provided.

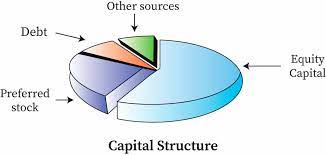

25. Explain capital structure. Name the principles of capital structure management.

Capital structure is a combination of sources of funding to raise the long-term funding needed for a business purpose to increase a company’s capital. We need this capital structure on the organization chart, which is a combination of debt and capital.

Furthermore, the management provides access to the capital structure needed to fund upcoming progress and improve the financial programme. The basic principles required for capital structure management are as follows:

- Cost principle

- Control principle

- Risk principle

- Principle of flexibility

- Principle of time

26. What are your long-term goals as an income expert?

The important thing is to focus on what you can achieve as well as what you are doing to achieve it. To illustrate, I want to be the best accountant your company employs within 5 years. Further, I want to strive to be a trusted expert for others. And when I do that, I would feel ready to take on greater responsibility.

To be precise, this is what I am doing to prepare now. Next, let’s go ahead and use an example to show what we are doing to achieve our goals and targets.

27. Please elaborate on the disadvantages of a private company.

There are certain disadvantages of a private company:

Unlimited liability

In such companies, the owner’s responsibility is unlimited because the owner makes more revenue by providing the company with personal wealth. Likewise, the owner takes a high risk to increase the amount of business.

Restricted financial resources

As the sole owner of the company, the availability of funds from various sources is under high restriction.

No legitimate status

The survival of a company is due to the actuality of a sole proprietor. However, the business will terminate due to the death or bankruptcy of the sole proprietor.

The limited ability of a person

Because a person has limited knowledge and skills, his or her ability to take responsibility, make quick decisions, and take risks is restricted.

In the case of a private company, it is not easy to transfer a business

Higher taxes

Since the sole proprietor is a direct person who enjoys profits, he must pay higher taxes.

28. What is PAN?

The taxpayer number( PAN) is a 10-digit number provided by the Income Tax Office in the form of a coated card. This is because PAN allows departments to link all types of individual dealings to the department. Further, these dealings comprise tax payments, income/assets/gifts/FBT income, TDS/TCS credits, definite transactions, communications and more.

In addition to it, PAN assists departments to maintain honest data of each individual’s dealings with 10-digit numbers and avoids tax evasion.

29. Explain Commercial tax.

Commercial tax is a tax levied on the proposed goods, which is indirectly collected from the seller or buyer and includes sales tax, entertainment tax, luxury tax, immigration tax, and occupation tax.

30. What does Transfer income mean?

Income transfer means that someone holds ownership of the asset but has a contract to transfer the income. However, you can still consider it as your income and will supplement your total income.

31. What is the additional charge? How can we calculate it?

The additional charge is an additional tax levied on the amount of income tax. For individuals/HUF/AOP/BOI/artificial corporations, if the taxpayer’s total income is 100 million rupees, an additional 15 % will be levied on the income tax amount. Similarly, for businesses, cooperatives, and local governments, an additional 12% is charged if the total income exceeds 100 million rupees. Again, for resident companies, an additional 7% will be levied on the income tax amount.

32. How do you stay uplifted at work?

The interviewer puts forward this question to find out your interests and the value you represent. Therefore, say that you are grateful for your job and show how it adapts you to that job by providing some best examples.

33. Please explain when this role failed and the lessons learned.

Again, this is the most frequently asked question in the category of income tax interview questions and answers. The answer to this question explains your potential to admit your faults and if you can learn from them. Hence, make sure to explain what the problem was, how it affected you and what you learned from it.

34. Why do you think you are the best for this role?

Through this question, the interviewing panel wants to know if you are energizing. Thus, emphasize your best qualities and ultimately link them to your job description.

35. Mention the best solution to handle stress and pressure.

The interviewer wants to enquire how you react to stressful situations. So, try to give some evidence which displays your calm state under pressure.

Henry Harvin

Henry Harvin Income Tax Course provides deep insight on Income Tax as well as the updated taxation policies. The duration of this course is 32 hours which is conducted on Saturdays and Sundays. Moreover, this income tax course also includes training, excellent study resources, and a certificate.

Why Should I Choose Henry Harvin?

- Ranked first Income Tax Institute by BestCourseNews.com in Delhi and Top 3 in India

- Recognized by the best media houses like Aaj Tak and Hindustan Times.

- 1-Year account for completion of Income Tax Course Academy Gold Membership+ Live Income Tax Training+ Boot Camp Session+ Internship+ Placement Support.

Other Taxation Courses

Final thoughts

To summarize, the candidates hunting for a good position in the government sector and interested in passing the exam will continue to pass the income tax interview questions and answers listed above and finally become an income tax office. Remember with persistent efforts you can succeed in your dream job.

Moreover, when you get a job at the Income Tax Bureau, you can enjoy many benefits such as stable employment, a stable income, a pension guarantee, and medical care. Thus, I hope this blog to answer the most frequently asked interview questions will help you crack your next job interview.

FAQs

Any individual who has done their graduation in any specialization from a reputed institution is eligible to apply. Furthermore, the pattern of the exam is completely objective. The exam will be conducted in four stages with 2 hours of duration.

Without a doubt, it is one of the most reputable jobs provided by SSC CGL. Moreover, the timely promotions and great social status make it a prestigious job.

The candidates must appear for the SSC CGL examination. In addition, the Staff Selection Commission conducts the combined graduate level (CGL) examination for recruitment into different government bodies.

There is no limit to the number of trials. However, you should check your eligibility criteria before they are displayed. Different age criteria apply to different positions. However, for most positions, the minimum age must be 18 years or older.

As an income tax officer, you have the authority to evaluate any area where you find something suspicious.

I had done my course. after that i get interview call but i was afraid of interview questions but after read all the article i was cleared from myside. and cracked my interview. and now working with high salary with m,y dream job