Preface

We have a comprehensive Income Tax Interview question and answer guide to clear your fears of clearing the Interview Section for the Income Tax department of an organization.

As Applicants, you have made it this far, by easily and effectively answered one of the toughest examinations, the main Income Tax Examination and are now preparing yourself for the quicker Income Tax Interview section.

About Income Tax

Income Tax is the tax paid by every citizen to the Government of India(GoI), this is a tax collected on the annual income of the ‘person’, the rates of taxation are determined by the tax slabs established for the categories of person.

The taxes are collected via the income tax authorities, working under the active subheads of the CBDT and The Department of Finance, Government of India.

The Income Tax collected is used in various governmental developmental projects in India.

Aims and Disclaimer

In this blog we have included 30 questions from the Income Tax Interviews of the years past.

These questions have the most frequently asked Questions relating to Income Tax Interviews which our applicants and readers have attempted and succeeded in the years past.

This Blog can be used as a guide for all applicants with an interest in Income Tax, MBA, Finance and even CA Studies as a supplement

as a basic framework for your studies, ensuring you pass your Income Tax Interview with flying colours.

To learn more about the Income Tax Process, just need a refresher in the world of Income Tax, Check out the Income Tax course offered by Henry Harvin.

Here are our top 30 Income Tax Interview Questions and answers

1. Give Introduction about yourself

This is an icebreaker question. Feel free to talk about yourself.

Keep it simple, Talk about your name, your place of birth, current residence, Employment, family, hobbies and interests you pursue in your free time.

You may also mention your reasons for aiming to be an Income Tax officer for the organization when prompted.

This is asked to make you feel free and calmer.

2. Define Financial Year

Financial Year is the period from 31st March to 1st April of the next year. The financial year is useful to calculate taxes and dues of individuals and organizations.

3. What is Income Tax? How is calculated?

Income Tax officers use this question repeatedly to determine the basics of the candidate. In the Income Tax interview, The question asked would elicit an answer of the following, Income Tax is a tax charged on the income of a person by the Central government, The rates of taxation are determined in the Union Budget of the previous year.

4. What is Assessment year

Assessment year is the timeframe immediately following the concluded Financial Year where persons are required to assess for and complete the filing of their taxes,

The government also uses this time frame to initiate the Union and State budget where policies and taxes for the New Financial Year are announced.

5. Who is an Assessing Officer

Every Income Tax payer is given an authorized Assessing officer(AO) based on the local address provided.

The AO manages all the documents and sends it to their superiors to ensure the smooth and safe processing of Income Tax.

Any Issues with the Income Tax is communicated via the Assessing Officer of the nearby address.

6. Who collects Income Tax?

The Central Government, The Government of India Collects Income Taxes.

Taxes are collected following guidelines and laws by the Central board of direct taxes(CBDT)

Taxes are collected by Banks, Tax Deducted at Source[ TDS] tax deducted while receiving salaries for instance and Tax Collected at Source[TCS] which is a tax collected when person purchases a good/service.

7. Why should the public pay our income taxes?

In the Income tax interview, the question may be asked.

Income Tax is one of the main sources of revenue for governments.

The Income Taxes collected by the public annually helps the Central government to fund their numerous social and economic development projects.

It also helps the government to form accurate assessments on the social, economic strata of its interwoven population.

8. Who is Exempt from Income taxes? Why?

All Persons are liable to pay Income Tax. However, there are exceptions, a few have been mentioned below

Under the Union Budget of 2020-21, Here is a list of sections where taxes are not collected ,Exempt from taxes.

|

Section |

Nature of Income |

|

10(1) |

Agricultural Income |

|

10(10D) |

Receipt from Life Insurance Company |

|

10(16) |

Scholarship to meet the cost of education |

|

10(15)(vi) |

Interest on notified gold bonds |

9. How is Income Taxes calculated

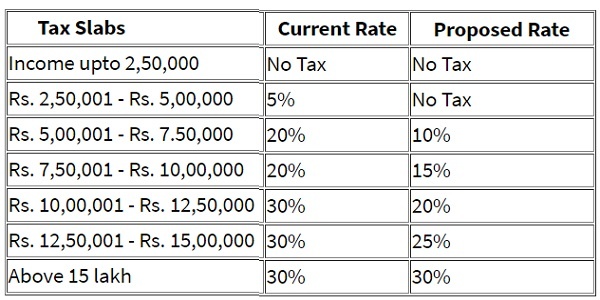

Income Tax is calculated on basis of the applicable tax slab.

Your total income is deducted on criterions, the resultant amount of which is placed under tax slabs for Income Tax.

A Tabular representation of tax slabs as proposed from the union budget of 2019-20 is shown below.

10. What is advance tax

Advance Tax is the amount of tax paid much in advance rather than a lump-sum amount at year-end.

It is also known as Earn Tax, the following advance tax is paid in instalments as per deadlines given by the Income Tax Department.

Hydrate yourself.

To read more on Income Tax Interviews Questions and Answers,

Check out the blog on Henry Harvin Education.

11. Where all Income taxes are applicable

Income Tax is categorized under the following five heads

- Salaries

- Income from house

- Profits from business/ profession

- Capital gains

- Income from other sources

Taxes are deducted from total earnings and are then placed to separate slabs for further streamlined processing.

12. Define total Income

It is the complete income on which Income Taxes are levied and paid to the government.

Total income is a combination of salaried income, Other profits such as business earnings, capital gains, and income from sources such as House rent, property lease, Royalties among others.

13. Define Gross Annual Income

Gross annual income is the total income a person would receive without taxations or other deductions, by the Union, and authorized third party organizations.

14. Differentiate between Annual and Gross Annual Income

|

Annual Income |

Gross Annual Income |

|

It is of earned in one financial( financial) year |

Gross Annual Income is income earned without any deductions by the form of taxes or other deductions |

|

Includes Salaries, other profits, income from other sources |

Includes Salaries, other profits, income from other sources accumulated till date. |

15. Define Excise?

Excise tax is an Indirect tax charged on manufacture, sale of goods; Some goods taxed under Excise are cigarettes and alcohol and in services such as gambling.

If the candidate has applied for a multinational company(MNC), during the Income Tax interview stage, this question may be asked.

Excise taxes are levied by both state and Central authorities.

16. Define Customs charges

Customs are the taxes levied on the object when it is transferred internationally, or when the person brings it to India.

17. What are Excise and Customs duties? What functions does it serve?

To shorten the length of the question, the Interviewer in the Income Tax interview clubs the above questions to a unitary question.

Excise duties are the indirect tax imposed by the State and Central Government in India on the manufacture, sale of certain goods the prominent being cigarettes and Alcohol. Services such as gambling and winnings are also taxed under Excise tax.

Customs duties are charged on the import and export of goods to and from India.

Customs officials are found in all major international airports, roadways for private persons and an In-house Customs department is set in all MNCs in the country, to deal with the process of customs duties.

18. Mention the charges incurred on importing goods to India

Customs Duties and Integrated GST will be the charges on importing goods to India.

19. What is Income Tax Returns

Income Tax Return(ITR) is a form which the person is required to submit to the government of India- specifically the Income Tax department of GoI.

The ITR contains information on the income of the person and taxes to be paid during the running Financial year.

The user must download the applicable ITR, print and fill the form offline and scan the copy.

20. Explain the process of filing for Income Tax Returns

Upload the Scanned copy in the website and fill in the relevant sections.

To read more on Income Tax Interview Questions and Answers scroll below.

To know more about Income Tax and achieve certification,

visit the Henry Harvin Income tax course.

21. How does the Income Tax authority determine the taxable of its citizens?

This question is a must in any Income Tax Interview, Income Tax department calculates the taxability of its persons under it by means of tax slabs.

The Income to be taxed is calculated after all the expenses incurred in the year is deducted from gross annual income.

This annual income is then placed into relevant tax slabs corresponding to the New and Old Taxation regime chosen by the user.

22. Income Tax findings are used by? And how?

Income Tax findings are used by the government to predict and implement more comprehensive guides and amendments to categories of interest.

Income Tax acts as a major source of revenue for the GoI. The taxes collected are used in the budgets to spearhead numerous development initiatives and proposed projects in India.

23. Are Income Tax records available to the public for perpetuity?

Income Tax Returns are public documents and are accessible on the directives of the government.

In the Income Interview, It is worth mentioning the court case of Pragati Green Meadows and Resorts Ltd. Vs M. Praneetha (Telangana High Court) where the court established the fact that Income Tax returns are public documents, accessible to the court and their use in legal proceedings no way violates article 21 of the government of India, They are public government documents and as such accessible to others.

24. Income Taxes come under the department of?

Income Tax comes under the Central Board of Direct Taxes (CBDT), the CBDT establishes rules, guidelines for the Taxation of persons in India.

This is managed by the Department of Finance, Government of India.

25. Define Person

This is one of the first clarification questions asked in the Income Tax Interview for any organization or individual.

The candidate when faced in Income Tax Interview with Question and Answer the book definition-

In terms of Section 2 (31) of the Income Tax Act, 1961, a person has been defined to include

- an individual

- a Hindu undivided family

- a company/ firm

- an association

- a local authority

- Law Enforcement and agents of Judicial system

26. Define Previous year

Previous Year is termed as the year preceding the financial year. It is also the year in which the Income earned becomes taxable for the upcoming assessment year.

27. Define Term Person

The term” Person” under the Income Tax act refers to an individual, an ordinary partnership where the individuals work for an organization on basis of a legal agreement.

In a “Term Person”, This question asked in the Income Tax Interview, refers to a Hindu Undivided Family(HUF), a company, firm, association of persons, local authority and Artificial Judicial Persons- NGOs, Universities among others.

28.How to determine the residential address of an individual

Firstly, Determine whether the person is the individual is resident or not,

- To know as the Individual has resided in India for 182 or more days the financial year

- A resident can then be classified into a resident and ordinarily resident(ROR) and Resident and not ordinarily resident(RNOR).

- If the individual is a resident and a ROR, with considerations if they are travelling abroad on approval by the Central Government or a crewmember in an Indian Ship.

- In the case of Resident but Resident but not ordinarily resident(RNOR), the same laws are applicable.

No residential address is recorded of a Non-Resident of India, Citizen of another Country.

29. Define non-resident? Are they required to pay their taxes?

If you have applied to an MNC with offices worldwide, This question is likely to be asked/ known during the Income Tax Interview,

Our Guide for Income Tax interview Questions and Answers Aims to answer the question.

It is an individual who does not come under any conditions for the previous Financial year, is termed as a non-resident.

The conditions are:

- You( The Individual) have to be in India for 182 days of the year

- and in long term cases of absence from India

- you would have stayed in India for 1 year-365 days during the last 4 years before the previous year and a total of 60 days in the last year.

30. Define the following terms

Income Tax refund-

the Income Tax Refund is the excess tax paid by error than actual owed amount, the excess is returned to you after taking into consideration Income tax, tax deductions and other factors.

Income Tax Audit-

In an Income Tax Audit is an assessment conducted by the Revenue Department by a company to look over the company finances, Look at its profitable sectors and make sure no errors in finances were made.

Deferred Tax-

Deferred tax is the liability the company has to pay taxes but does not pay for in the current Financial Assessment and would pay for in the future.

This case occurs if the organizations/association or any person has a discrepancy in their recorded financial statements, books and other evidence to the Current Taxation guidelines established by the government.

Capital-

The capital means the assets and cash in the business, Capital can be cash, machinery, received accounts and cash.

31. What is PAN? Explain its uses.

Permanent Account Number(PAN) is a special 10 digit alpha-numeric string of characters generated by the CBDT and the Income Tax Department, which is essential to calculate your Income Tax records.

To track Financial status of an Individual, PAN Numbers are linked with Bank accounts.

and records information such as Tax Deducted on Source(TDS), Tax Collected at Source(TCS) and Gifts received or Income from other sources.

For Practice

In an Income Tax Interview, It is important to know your audience and have detailed answers ready for real-world situations regarding the industry and line of work.

The Income Tax Interview Questions and Answers are for all applicants with an interest in Income Tax and its numerous sections.

To hone our skills, we have a list of practice questions that you can answer.

A list of Frequently asked Questions by public on Income-Tax is provided for clarity.

- What is Capital? Capital gain?

- Define working capital

- Explain Deferred tax? Deferred tax excess and liability

- Briefly explain Streamlined sales.

- Explain about GST

- What is PAN ( PAN CARD)

- What are provident funds? Mention its types

- Timeframe for the financial year

- Time duration of assessment year

- What is income tax

- Where to submit Income Taxes documents? Offline? Online?

- Does multiple bank accounts make you more likely for higher Income Tax?

- Penalties for not paying Income Tax

- Role of Income Tax Department? In Raids and Spot audits?

- Role of Enforcement Directorate? And the powers within them

- Note on Income Tax Enforcement agencies

- What happens if an NRI does not pay his Taxes

Conclusion

Income Tax sees an peak in Interest in the Months of March- April when ads on Television(TV) are aired.

The candidate must be ready for solutions to the questions asked in the Income Tax Interview.

It is your Income Tax Interview for any organization, We wish you all the best for the upcoming Income Tax interview!

Do let us know how was our guide for Top 30 Income Tax interview questions and answers were and let us know your thoughts!

Frequently Asked Questions (FAQ)

Income tax is the tax collected by the Central Government of India on the annual income of a person. The tax collected is the main source of income for the Central Government using the tax collected in its various projects.

The Time duration from the 1st of April to the 31st March when Income from its various heads are earned by the person is called the Financial Year. Income Tax returns are filed by the person at the end of the Financial Year, hence accounting their finances to the government for the concluded financial year.

The time immediately after the end of the Financial Year where a person files for his Income tax returns forms is called the Assessment year. For instance, The Assessment year of FY 2021-22 begins in April, immediately after the end of the Financial Year which started from 31st March 2021-1st April 2022.

Permanent Account Number(PAN) is a special set of 10 digit alpha-numeric characters generated by the Income Tax Department to all holders of the PAN Card.

PAN Card is used by the government to track the financial tax-paying status of each person, PAN cards are linked with banks and other financial institutions to better track the individual tax-paying records.

The Income Tax Department enforces the following of the Income Tax laws in India, Conducts routine checks on Individuals of Intrest and Helps keep an eye for transactions in Black- money, Money Laundering Fronts and takes action against them.

The Enforcement Directorate enforces the provisions of the Foreign Exchange Management Act(FEMA) and its sister laws, These Laws curb efforts for Money Laundering and Financial fraud. ED has the right to raid institutions suspected of committing these felonious deeds and can order penalties or jail term for the accused.

Very useful write-up. I got almost all the details I needed to know through this single article itself. Appreciate it.

I have learned more facts from this single piece of writing than from anywhere else. I really appreciate the effort made by the team.

I have learned reality of tax like how to give proper answer how to clear exams. really good blog and effort.